For 15 years, I’ve been thinking and writing about how federal policies and programs have driven house prices ever higher and betrayed the true promise of home ownership: financial autonomy. Last fall, I went to Ottawa and testified before the Finance Committee about this one-way bet on higher house prices and a potential solution. Among other things, I lamented the massive misallocation of capital to an unproductive asset class and explained that high house prices are responsible for much of our so-called cost-of-living and productivity crises.

They…weren’t particularly interested.

If only I had known about Ouroboros Ourboro last October! I could have entertained those MPs with an ironic story about the how the best example of Canadian financial engineering I’ve seen in years (and I see a lot of natural resource projects) is a leveraged play on residential real estate…backed by the CMHC. Who said Canada doesn’t innovate?

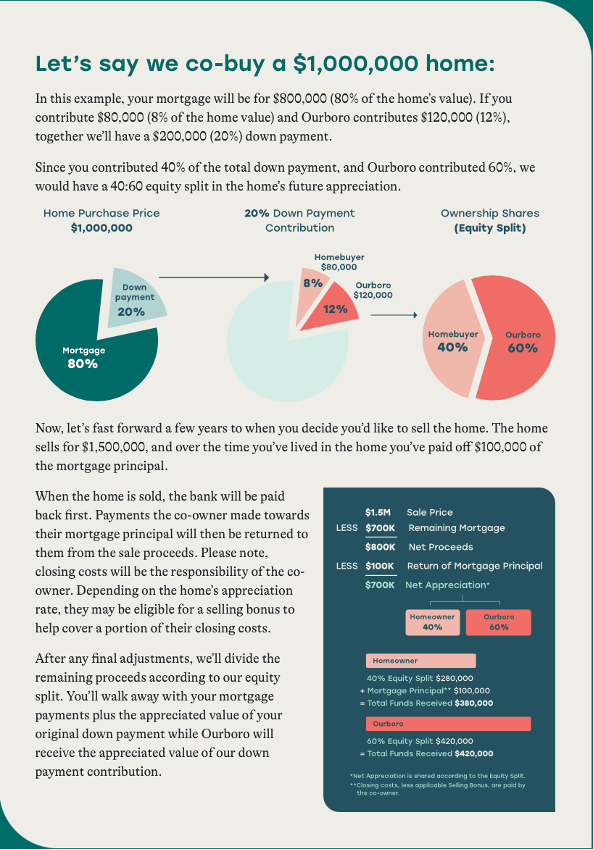

Here is the basic structure:

- For aspiring homeowners who have saved a downpayment of at least 5% (but less than 20%), Ourboro will provide the “missing” equity required to get them 20% and thereby avoid the regulatory requirement for CMHC mortgage insurance.

- This boost not only saves the homeowners the CMHC premium but also keeps them off the CMHC books (and preserves room under that precious $800 billion statutory cap on mortgage insurance and securitization guarantees).

- The Ourboro investment is not a loan: it is an equity investment in the property.

- In exchange, the co-owner agrees that, upon sale of the property, Ourboro will receive profits proportionate to its share of the downpayment.

- So, if the “homeowner” provided 5% and Ourboro provided 15%…then Ourboro gets 75% of the gains.

It’s my new favourite trade. I can’t wait for the retail version. Where’s the ETF?

The company (Ourboro Inc.) appears to benefit from two special aspects of Canadian residential real estate market:

- Low-risk leverage

- Extensive government intervention in the Canadian mortgage markets has transferred most of the risk from lenders to the CMHC, which means we “enjoy” relatively abundant, stable, and cheap mortgage credit (and suffer much higher, debt-fueled house prices).

- By providing an equity investment, Ourboro enables home buyers to qualify for larger mortgages.

- The buyer is on the hook for the mortgage.

- Ourboro benefits from the leverage but is not responsible for the debt.

- Tax-free capital gains

- The infamous principal residence exemption makes Canadian residential real estate first among equals: no other asset class is completely untaxed.

- Residential real estate receives an uncapped and entirely artificial advantage. Again, the sources of our “productivity crisis” are not a mystery. We just don’t want to take the medicine. We should revisit St. Augustine: “Give me chastity and continency and affordable housing, only not yet.”

- The company’s own “math” shows no capital gains paid upon sale of the house (or on Ourboro’s share of the profits).

- The final FAQ on the firm’s website makes brief reference to a “trust agreement” that could implicate the co-owner in certain provincial and federal “tax regulations” that may require “additional tax filing requirements”…but it makes no reference to compromising the principal residence exemption or obligating the co-owner to make capital gains payments.

- Even if Ourboro does pay capital gains tax on its share of the profits, it still benefits indirectly from the principal residence exemption because the individuals who buy the home from the co-owner will factor the benefits of the PRE into the price they are willing to pay (as will their mortgage lender(s) and any co-owner(s)).

- What is it the economists say? “Solve for the equilibrium”.

- The infamous principal residence exemption makes Canadian residential real estate first among equals: no other asset class is completely untaxed.

These private investors have figured out how to capitalize on the most advantageous aspects of federal mortgage policy, which were supposedly designed to serve individuals and families. They even got an honest-to-goodness “Capital Markets Reporter” to write an encomium article that describes their incisive play as “help from Ourboro” in service of “an incredibly worthy cause.” With no hint of sarcasm or reference to any potential tax consequences.

Never forget: nearly 50% of adult Canadians struggle with basic literacy and numeracy.

Corporate co-ownership and federal support for such “innovations” represent yet more unbalanced financialization of Canadian housing: the conversion of houses into highly leveraged financial assets, which is apparently just fine with the feds so long as number go up.

Such instruments and policies promote homeownership in name only (HINO?), as “house rich, cash poor” families take on more debt and dilute their equity just to get their names registered on title. To what end?

Prices are falling and demand in major markets is frankly all over the place. Evidence is mounting that our collective, speculative fever may have burned itself out:

- a “slim majority” of Canadian adults (52%, including 47% of adults 55+) think house prices need to fall further;

- large condo developers are begging the provincial and federal governments to restart the foreign speculation machine but receiving a very cool reception, at least from British Columbia and certain pundits (the feds remain unfortunately fixated on their familiar tools of tax breaks and opaque subsidies); and

- some observers are finally and publicly connecting our over-investment in residential real estate to our persistent productivity problems.

More likely, of course, our national passion for tax-free leveraged capital gains has just gone underground for a while. Like one of those zombie fires up north, it will smolder incognito for a few months until conditions are ripe for another inferno.

Hope springs eternal, especially when it is heavily subsidized and the only real game in town.

Main St., Vancouver, BC

Leave a Reply